Several state leaders will be on hand for “Connecticut at the Crossroads: A Conversation about the State’s Present and Future,” a timely panel discussion at

As approximately 250 people looked on, Democratic First Selectman-elect Daniel Rosenthal, plus several dozen other recently elected town officials, took their oaths of office in

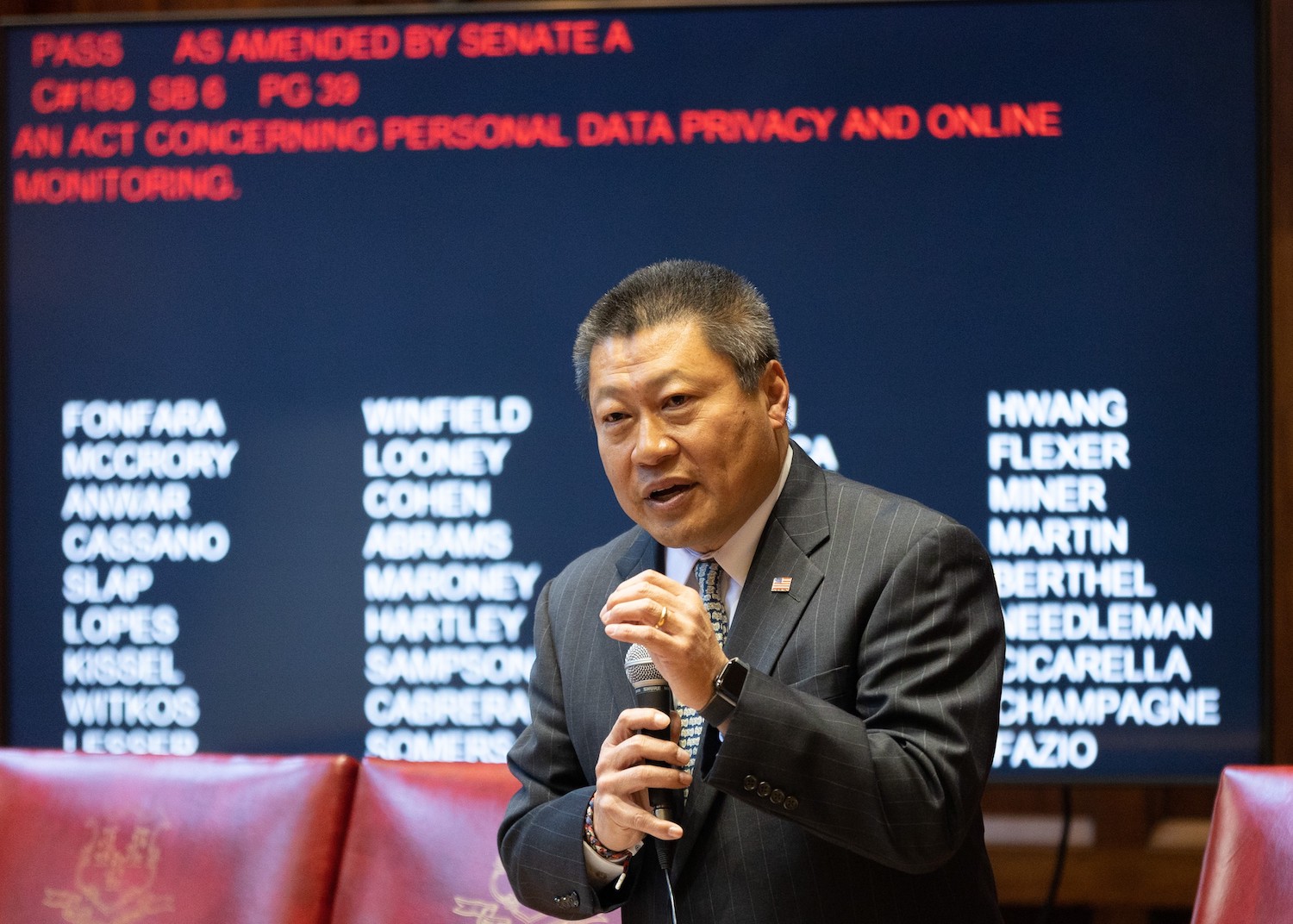

On Nov. 28 at 5 p.m. in the Martire Forum, the university will host State senators Toni Boucher, Bob Duff, Tony Hwang and State reps.

Hwang (R-28) along with State Reps. Laura Devlin (R-134) and Brenda Kupchick (R-132) are co-hosting a Pints and Politics legislative conversation with Fairfield residents Monday,

State Senator Tony Hwang along State Reps. Laura Devlin (R-134) and Brenda Kupchick (R-132) are co-hosting a ‘Pints and Politics’ legislative conversation for all Fairfield residents.

The event will be held on Monday, December 4th between 6:30 pm – 7:30 pm at Local Kitchen & Craft Beer Bar on 85 Mill Plain Road in Fairfield.

Now that Connecticut finally has a budget. Let’s talk. This is a chance to talk to your three Fairfield legislators if residents have questions they might have regarding the just adopted state budget, the upcoming 2018 legislative session, or any state issues of interest to them.

For anyone who is unable to attend but would like to talk to Reps. Devlin and Kupchick at please contact their office at 1.800.842.1423 or Sen. Tony Hwang at 1.800.842.1421.

The legislative conversation is a ‘cash bar’ event.

Fairfield state lawmakers are applauding the governor’s Oct. 31 decision to sign the historic, bipartisan vote on a state budget to close a projected $3.5 billion deficit over the next two years.

The bipartisan budget eliminates the Governor’s executive order that deprived schools, communities, and nonprofit social service organizations of essential funding for 123 days.

“As I have previously stated, this budget begins the process of turning our state around and represents a new approach to budgeting that has not been seen in many years,” said Rep. Brenda Kupchick. “I am relieved that the governor has decided to act responsibly and not prolong the budget stalemate that has affected residents in Fairfield and across Connecticut. Although this budget contains serious shortcomings that we have to address as soon as possible, the final budget product could have been a lot worse than it was. I am proud of my colleagues for standing up to the governor and getting this passed into law.”

Rep. Laura Devlin said, “This budget represents a hard fought victory for the families and taxpayers of Fairfield. We were able to protect Fairfield’s municipal and educational state funding after multiple attempts to punish our community for having our fiscal house in order. I am also proud we were able to stop the governor’s ill-advised proposal to shift the teachers’ pension costs onto cities and towns which would have crippled Fairfield with an unexpected financial burden.”

Sen. Tony Hwang said, “We desperately needed to pass a budget to ensure the people of Fairfield and the communities of Connecticut did not suffer irreparable damage. I am relieved that we finally have a bipartisan budget for Connecticut. Legislators stepped up to lead during the state’s fiscal crisis and make difficult but sound choices. Importantly, this plan does not transfer the state’s responsibility of teacher pension payments onto our local town budgets. It implements long overdue structural changes to how we govern into the future. Much more needs to be done, but I am excited to begin with this budget as a catalyst toward a better Connecticut. We must keep working to pass budgetary policies which bring about predictability, stability and transparency in our state.”

The budget is the result of bipartisan negotiations and contains policies from both Democrats and Republicans, including:

More information and details can be found at www.cthousegop.com and at www.ctsenaterepublicans.com.

Subscribe to our newsletter to stay updated.

YOUTH MENTAL HEALTH CRISIS For over 2 years, I have been an outspoken advocate for the health and well-being of

My common sense approach is focused on a relentless commitment to our community and maintaining the balance between local governance

BUDGETING IS ABOUT PRIORITIES. We are now battling historic inflation levels and supply chain challenges for food/fuel/material goods that are

As we adapt to a new “normal” from the Covid-19 pandemic and the tumultuous social upheaval of recent Supreme Court

Subscribe to our newsletter to stay updated