Fairfield Lawmakers Applaud Bipartisan Budget’s Passage Into Law

Fairfield state lawmakers are applauding the governor’s Oct. 31 decision to sign the historic, bipartisan vote on a state budget to close a projected $3.5 billion deficit over the next two years.

The bipartisan budget eliminates the Governor’s executive order that deprived schools, communities, and nonprofit social service organizations of essential funding for 123 days.

“As I have previously stated, this budget begins the process of turning our state around and represents a new approach to budgeting that has not been seen in many years,” said Rep. Brenda Kupchick. “I am relieved that the governor has decided to act responsibly and not prolong the budget stalemate that has affected residents in Fairfield and across Connecticut. Although this budget contains serious shortcomings that we have to address as soon as possible, the final budget product could have been a lot worse than it was. I am proud of my colleagues for standing up to the governor and getting this passed into law.”

Rep. Laura Devlin said, “This budget represents a hard fought victory for the families and taxpayers of Fairfield. We were able to protect Fairfield’s municipal and educational state funding after multiple attempts to punish our community for having our fiscal house in order. I am also proud we were able to stop the governor’s ill-advised proposal to shift the teachers’ pension costs onto cities and towns which would have crippled Fairfield with an unexpected financial burden.”

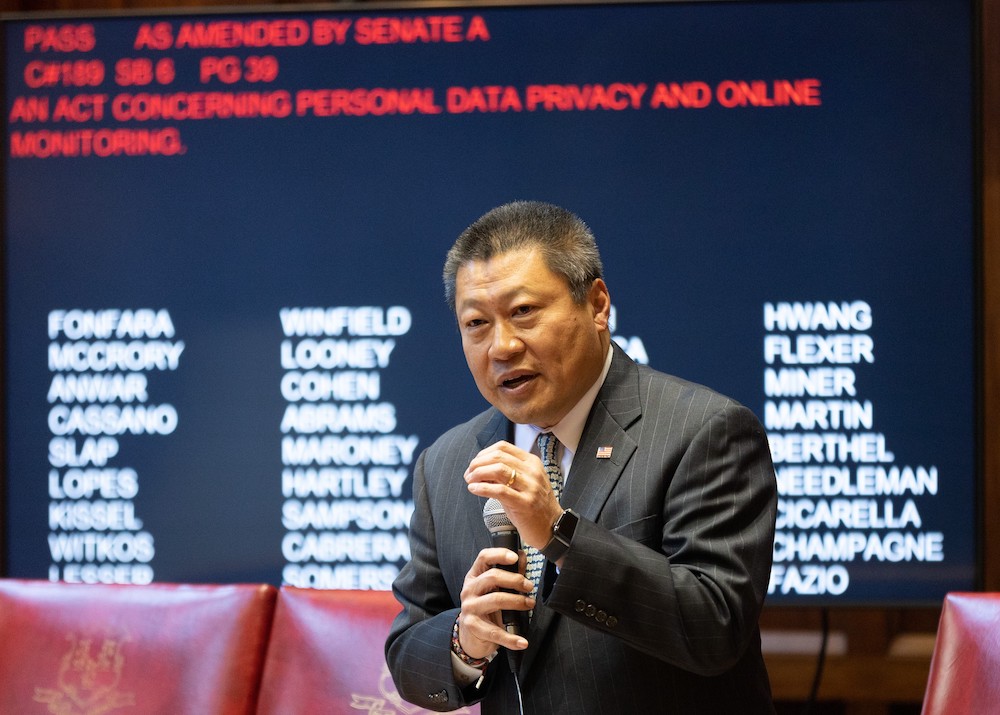

Sen. Tony Hwang said, “We desperately needed to pass a budget to ensure the people of Fairfield and the communities of Connecticut did not suffer irreparable damage. I am relieved that we finally have a bipartisan budget for Connecticut. Legislators stepped up to lead during the state’s fiscal crisis and make difficult but sound choices. Importantly, this plan does not transfer the state’s responsibility of teacher pension payments onto our local town budgets. It implements long overdue structural changes to how we govern into the future. Much more needs to be done, but I am excited to begin with this budget as a catalyst toward a better Connecticut. We must keep working to pass budgetary policies which bring about predictability, stability and transparency in our state.”

The budget is the result of bipartisan negotiations and contains policies from both Democrats and Republicans, including:

- An enforceable spending cap

- A bonding cap of $1.9 billion

- No broad sales tax increases or income tax increases

- A new formula to ensure education aid is directed proportionally to towns based on need.

- Predictable municipal aid so that towns and cities know what they can count on from the state

- No shift of teacher pension costs onto towns and cities thereby saving towns, cities, schools and taxpayers from shouldering another financial burden

- Significant mandate relief to help municipalities achieve efficiencies, foster cooperation between school boards and local governments, and pass savings on to taxpayers

- Targeted spending cuts and reductions to state government agency accounts, excluding cuts to core services

- A hiring freeze on non-24-hour non-union positions

- Manageable reductions to higher education institutions, while aid for scholarships for low- and middle-income students was preserved

- Protection of funding for core social services and programs that benefit people most in need

- Full funding for day and employment services for individuals with intellectual and developmental disabilities

- Protection of funding for mental health and substance abuse treatment programs.

- Protection of aging in place initiatives are protected by restoring funding for the CT Home Care Program and opening it to new participants

- Increasing funding for Seniors Meals and non ADA dial a ride, and preserving the personal needs allowance

- Lowers taxes for retirees by eliminating the tax on social security income

- Lowers taxes for retirees by eliminating the tax on pension income for single filers with an AGI below $75,000 and joint filers below $100,000

- A plan to stabilize the Special Transportation Fund by dedicating transportation-related revenues to fund transportation needs. Without this change, the STF was projected to be insolvent by 2021, which would put all transportation projects in jeopardy.

More information and details can be found at www.cthousegop.com and at www.ctsenaterepublicans.com.